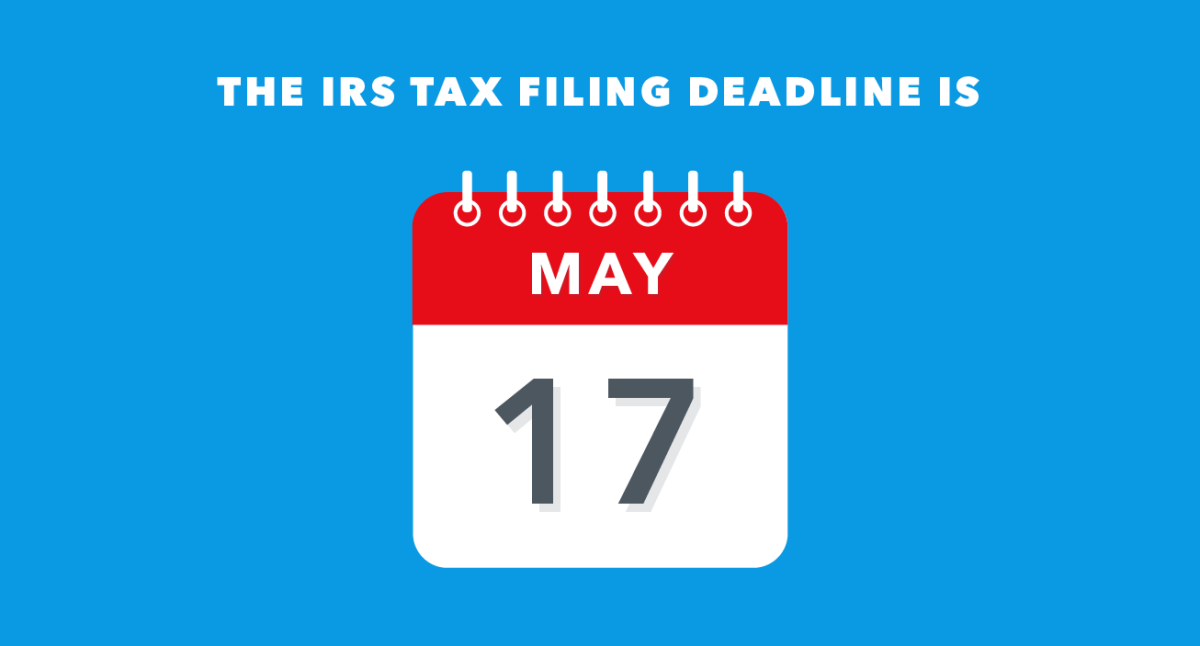

What's The Deadline To File Taxes 2025 - If a taxpayer isn't able to file by the april 15 deadline, they can. Canadian tax filing deadlines for 2025 (including COVID19 update), Page last reviewed or updated: 16 in 2025 that date falls on a weekend.

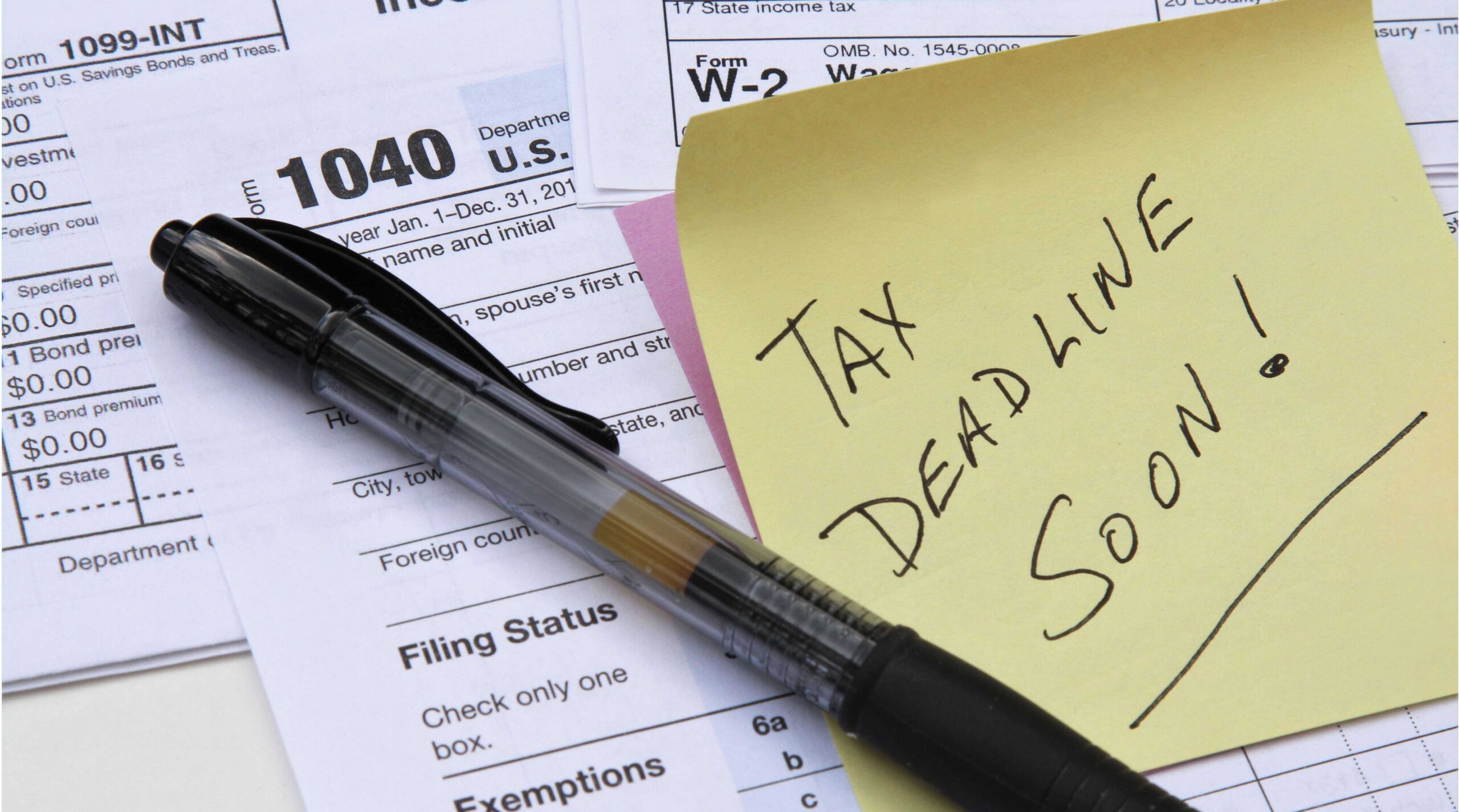

If a taxpayer isn't able to file by the april 15 deadline, they can.

When Are Taxes Due in 2023? Tax Deadlines by Month Kiplinger, If you fail to meet this deadline, you may be assessed a penalty when you file your tax return. As of january 29, the irs is accepting and processing tax returns for 2023.

What you need to know about the IRS extension of tax deadlines C, People who live in areas that were affected by natural. Deadline to contribute to an rrsp, a prpp, or an spp apr 30, 2025 :

The usual federal deadline is april 15, and for residents of all but two states — massachusetts and maine — that’s the deadline this year for personal federal tax.

The deadline this tax season for filing form 1040, u.s. Deadline to file your taxes if you or your.

Important Tax Deadlines for 2023 Market Street Partners, This year’s tax day is april 15, 2025. If you chose to file an extension request on your tax return, this is the due date for filing your tax return.

Changes to Tax Deadlines for 2025 Scharf Investments, If you chose to file an extension request on your tax return, this is the due date for filing your tax return. If a taxpayer isn't able to file by the april 15 deadline, they can.

What's The Deadline To File Taxes 2025. If you fail to meet this deadline, you may be assessed a penalty when you file your tax return. You will then have until oct.

2025 Tax Filing Deadline and What You Need To Know, This is when individual taxpayers, sole proprietors, and c corporations need to file their taxes. If you chose to file an extension request on your tax return, this is the due date for filing your tax return.

Tax Day Deadline to File Tax, What to Know KnowInsiders, As long as you paid an estimated amount that's close to what you owe, you won't be subject to fines or penalties if you file your return and pay any remaining tax. 15, 2025, to file your return but, you still need to make an estimated payment on.

15, 2025, to file your return but, you still need to make an estimated payment on.